In the next ten years, the best increase in housing prices in Australian cities is actually it!

Two weeks ago, after the article on self-protection of housing assets was issued, many friends have received attention and discussions. It seems that everyone is not only interested in real estate investment to make money, but also the enthusiasm for saving taxes and saving money is not to be underestimated.

But today I think I still want to change my appetite, because there is a limited crowd of people who are too technical to adapt to, after all, such as overseas buyers watching your local people do not have to pay this tax, but also save that tax, the psychological will certainly be unbalanced.

So today we still talk about some topics that are of interest to everyone. For example, which city in Australia will have the best price increase in the next decade?

1

What created the status quo of the property market today?

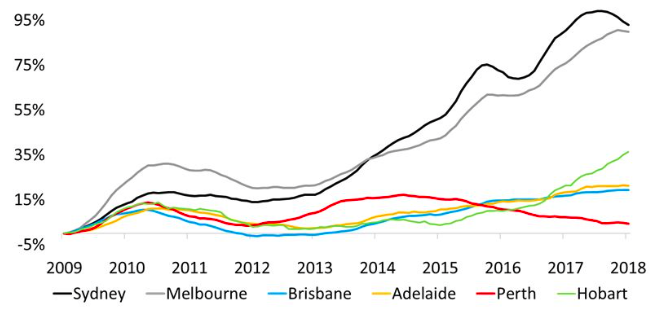

Before looking ahead, we may wish to review the past first. If we look at the housing prices in 2009 as a starting point, how have the capital cities in the past decade performed? An interesting chart from CoreLogic can be used for your reference.

Judging from this picture of the price growth trends of all capital cities in Australia over the past ten years, Sydney and Melbourne are the absolute winners of price increases during 2008-2017.

Please note that the vertical axis on the chart is not the absolute value of the house price, but rather the self-estimated gains for each city based on 2009 house prices. Therefore, from this graph, all cities in 2009 are starting from the same point, but this does not mean that the prices in these cities are the same.

From the chart point of view, Sydney, Melbourne, the initial price of real estate in early 2018, compared to their own 2009 house prices, rose by about 90%.

What makes people more eye-popping is that the city that ranked third in the past decade or so has turned out to be Hobart, the capital of Tasmania, which has a population of only 200,000. The price increase for the past ten years is 35%.

Perth, the capital of Western Australia, is relatively miserable. House prices have remained the same for almost a decade and have remained in a downward cycle since 2015.

Then look at this picture, you must want to know how this map will continue in the next decade, so you know where to go, right? However, before revealing the answer, we should ask such a question first: Why has Australia’s housing prices in the past decade been turned into today?

2

Grand Skyward’s Inspiration for the Property Market in Australia

Earlier this year, Professor Zhang Jun, a famous professor at the School of Economics at Fudan University, came to Sydney to give a lecture. I had the privilege of going to the scene and listening to Professor Zhang’s views on Chinese real estate. Some of them were very interesting. For us to ponder over the above question, Great reference value.

We all know that China’s real estate market began in 1998 and this year marks the 20th anniversary.

If we divide the Chinese real estate in the past 20 years into two stages, the first stage is 1998-2008, and the second stage is from 2008 to the present, then you can obviously find that in the first 10 years, Kitahiro There is a gap in housing prices between first-tier cities and second-tier and third-tier cities, but there is no huge gap;

From 2008 to the present, house prices in the first-tier cities have already rushed to the sky, and they have been riding for a ride. In many small cities, housing prices have risen weakly, and individual cities have occasionally seen some “ghost towns” and other appalling news.

How to explain this phenomenon?

Professor Zhang Jun believes that the reasons for today’s sky-high property prices in China’s first-tier cities are directly related to the transformation of China’s economic structure.

In the decade between 1998 and 2008, the Chinese economy continued to use traditional manufacturing and export industries as the pillar industries. During this period, a large number of manufacturing-intensive cities such as Kunshan, Dongguan and Wenzhou were created.

In contrast, first-tier cities have advantages, but the attractiveness of talent companies is not overwhelming. Therefore, the housing prices in first-tier cities can be temporarily covered at that stage.

But what have been the hottest industries in China in the past ten years? BAT, AI, sharing economy, high-end manufacturing…

These changes in the industrial structure have caused the population, capital, and social resources to gravitate toward first-tier cities, while the second- and third-tier cities have become less attractive to talent. As a result, the northern and southern wide and deep became a place where everyone would crush their heads, and it would be difficult for prices to rise.

Carefully thought about this, this is not exactly the same as the Australian situation?

Twenty years ago, Australia was still hailed as a country riding on mineral resources. Commodities continued to rise, pulling the economies of Queensland, Western Australia and many other regions.

If you look at the Australian housing real estate chart for 20 years, there are some phenomena that you could not imagine today. For example, Perth’s average annual increase in house prices from 1998 to 2008 was around 13%, and Brisbane’s apartments’ average annual growth rate was close to 10% over the decade.

Since the end of commodity bull market, depending heavily on regions and cities in individual industries such as mining, the period of rising housing prices is naturally a temporary paragraph. And a comprehensive city like Sydney Melbourne will not be affected too much by the rise and fall of an industry, and prices will naturally be firmer.

With the arrival of a large number of affluent overseas immigrants over the years, Australia’s own transformation in its economic structure has naturally led to the rising prices of housing prices in the two gateway cities of Sydney and Melbourne.

If we say that the rise and fall of a country is talking about the national transport, then the development of a city is seen as “urban transport”, and housing prices can be said to be the most direct reflection of a city’s transportation.

3

The best city for the next decade

Wandering for a long time, is it that you are hurrying with me, is not to say good predictions of the property market stocks in the next decade, how do you say that half a day is less than the key? !

Well, then the point is coming! !

If you just clicked on the title of this article and wanted to see what the future predicted by others would be “the best city in Australia’s property market,” then to see this, I might want to disappoint you because my conclusion is “I don’t know”.

Not only that, but the central idea of this article is to suggest that you shouldn’t easily trust anyone’s so-called predictions about the future, because the prediction market itself is not reliable.

The analysis of the first two-thirds of this article may seem very reasonable, but in fact, these are all conclusions about the facts that have already taken place, and are typical aftermath.

The reason why investment is an art is because although one can make a seemingly sensible summary of market performance that has occurred in the past, this does not mean that we can make accurate predictions about the future.

Looking at it now, people who bought an investment house in Sydney five years ago seem to be all investment experts, but in reality, they are only buying the right city at the right time. The so-called stand-up is on the air. But where is the next place? How big is the wind? How long can it be blown? No one can tell you because there are too many uncertainties and too many distractions.

So if the trend of the macro market is unpredictable, how can this problem be broken?

“

In fact, the answer is very simple. Smart investors will not rely entirely on average market growth to gain investment returns. The growth of the market is indeed very important, but it should be a bonus to the return on investment, and it should not be your only hope.

Leaver a comment