note! ATO will inspect millions of Australians! 7 tax problems in ten people

According to the “Daily Telegraph” report, Adam Kendrick, Assistant Commissioner of the Australian Taxation Office (ATO), said that after discovering widespread and incorrect tax deductions for mobile phones, workwear and car fees, ATO has increased resources to crack down on tax rebate applications. .

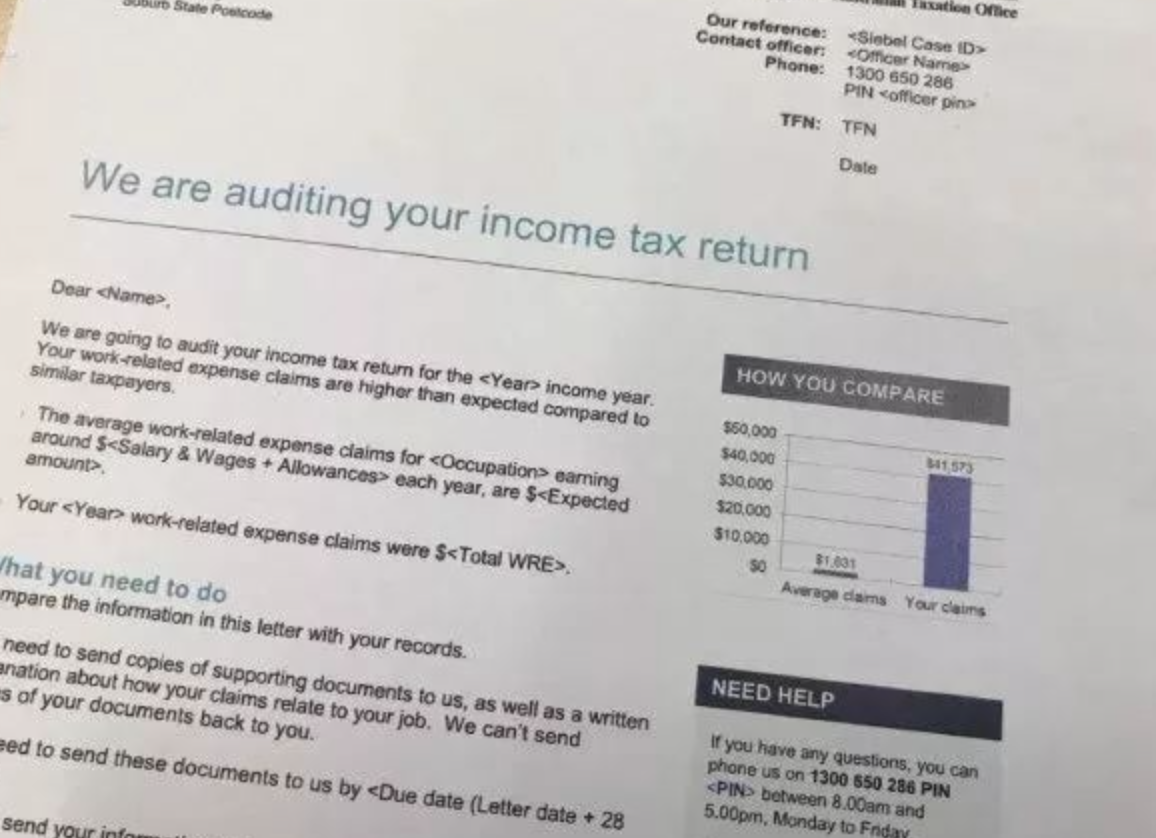

The ATO’s “Data Doctors” team compares employee tax deductions with those who engage in similar occupations and incomes, will investigate potential fraudulent tax refunds rigorously, and will cause 20,000 people to face a full tax review.

Kendrick said: “We found that 7 of the 10 tax returns we audited had problems.” The idea of being audited by the ATO made most people feel scared, even if they had nothing to hide.

Adrian Raftery, an associate professor at Deakin University, said that this is “a normal nervous reaction” and people tend to reduce their reasoning ability after receiving warning letters from ATO.

Dr. Raftery also revealed that ATO’s high-tech data matching system is improving every month.

Peter Bembrick, a tax partner of Mann Judd, Hong Leong Bank, said that the new rules mean that when the transaction exceeds 10,000 Australian dollars, the ATO will be eyeing people who invest in Bitcoin or other cryptocurrencies.

Technology is helping ATO receive more incorrect tax relief than ever before.

Bembrick said that anyone facing tax audits should take immediate action and back up their records. “The audit is not something anyone will like, especially if it delays.”

Most of the audit work was completed within 90 days. They usually make a phone call first, then write a letter, and ATO often talks with banks and employers. Kendrick said: “We also access third-party data, which may be immigration records, charging records, and any resources we can use to verify their claims.”

In addition, ATO penalties for false tax refunds may include high interest rate repayments, fines, and prosecution.

Tax agencies have also become the target, Kendrick said, ATO will also monitor those who provide the highest tax relief agents. We will pay close attention to DIY returns and send news about high claims in real time.

The three golden rules for ATO work:

1. You must have spent your money and have not reimbursed.

2, the cost must be directly related to your income.

3. You must have records to prove the transaction.

Leaver a comment