The Chinese boss went bankrupt overnight! Fear of being dominated by ATO for those years!

Do not know if you still remember such a clever Chinese boss.

Once he was a king, escaped the tax of more than 80 million New Zealand dollars, the family lived a rich and noble life, and later the Australian Taxation Bureau came…

Not only was he imprisoned but also returned to the country. The entire family returned to liberation overnight.

Divider Line Arrow Dynamic

The Australian Tax office (ATO for short) is what we call the Australian Taxation Office. As long as you have a valid visa in Australia, your every bank or cash income will be supervised by them.

Exhausted a lifetime, escaped a tax ATO introduced new information contrast technology, they will be based on your financial year-end declaration, each check your income, even your social software, Wechat microblogging, etc. will not be They missed it.

If you often sunk some of your “luxury” life on social software, you are likely to have been eyeing them!

Some time ago, ATO stared at the Chinese, crazy search of Chinese declarations, your every income can not escape their eyes, and even sent a staff who speaks Chinese, it seems that this time to play really!

This time, the foreign students will pat the buttocks again and say, What is the relationship with me? I’m not PR, and I’m not naturalized. How can I get it!

To remind the majority of international students here that although there is no PR or citizen, we only need to have a valid Australian visa, and as long as you live in Australia for more than 83 days, that is, a legal tax resident, you must apply for the Australian tax number. And submit a declaration at the end of each fiscal year.

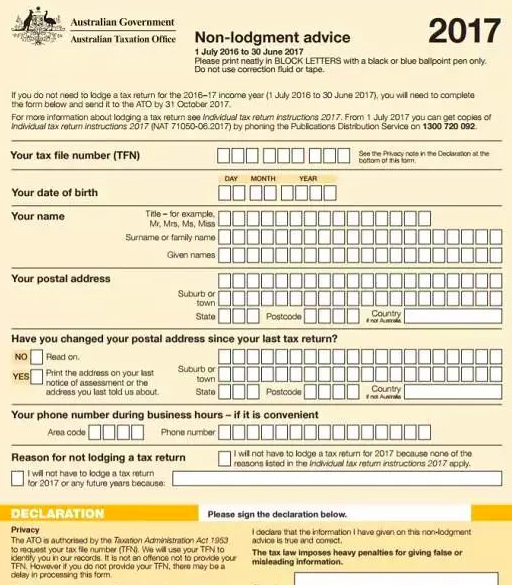

If you have already applied for a tax number, but you have no income or your income is less than the tax rate, you must also submit a non-income declaration form because we are Australian tax residents!

If you do not report on time, or if you do not pay taxes promptly, you will be fined by ATO Pay a Panalty Fee.

There are two conditions for receiving a fine, not reporting and not paying taxes on time.

If you do not declare, you will be fined 5% of the tax, until up to 100% of the tax, penalty to you doubt life, if you do not pay, they will … Pay interest interest.

If you think fines are not good enough, ATO will increase interest on your fines, because they think that not only don’t give money, but also waste our time! Generally it will be 4% to 6% of the total tax, and the ball of interest will roll bigger! Nothing is wrong, not a problem, some problems, some money! If you still think so, then they will begin to impose sanctions on you.

Get the notice from ATO notice

Your email will be subject to countless warning letters from ATO, because they have given you many chances before!

If you receive an ATO warning letter, don’t leave it! Hurry to contact them and make up for taxes in a timely manner. If you do not contact them in time, ATO may feel that you are still a bit skinned. The next step is to prepare for action and sanction you! If you contact the ATO in time, you must complete the tax within 30-60 days or they will sanction you! Anyway, you must sanction if you don’t agree!

Forfeit your refund Forfeited your application for a refund

If you still owe ATO money, do you still expect them to return money to you?

If you have declared income at the end of fiscal year 2017 and you have requested a tax refund from the tax bureau, but you did not report it in time or did not pay tax in time in 2018, would you still like to get this money?

Oh, young! ATO will make you see this money in your life, and even use your refund to make up for your arrears.

Nothing! No big deal, no refunds. I don’t want to pay taxes. So from now on, ATO will be with you, stop in the end!

Give up your Social Security

At this point, although they can’t attack your person and affect your work, they can attack your other property after some notification process: Social Security. For example, your free medical insurance, education loans, subsidies for childbirth, unemployment benefits, and even your pension insurance will be ruthlessly deprived of.

Just because you owe the tax office money! ATO allows you to live for a second!

Have your property seized

If these above are not a threat to you, then ATO will use your assets to offset!

Your house, car, and even home furniture will be moved by ATO as collateral. Not to mention your bank account. They are not picking anything at all. They will all be taken away.

But they are still human and will leave you wearing clothes.

Claim or summons receives a subpoena or claims claim

If you have reached this point, ATO will think that you will refuse to work with them to resolve the debt, so they will file a claim or lawsuit with the state court. After the court confirms, we will see you in court!

or…….

Bankruptcy notice Bankruptcy notice

If a bankruptcy notice is received, it is generally true that people who do not have the money to pay taxes have already fallen to the point of inability to repay…..

Then, applying for bankruptcy is the best choice because all your assets will be resold by the client, which means that you are really poor and you have left clothes, and for those who start the company, this is the best way to protect the company. Method.

If you are an individual, you can quickly pay taxes if you have enough money. ATO reminds young people not to play with fire! otherwise…….

Serve jail time

This step is really called a day or a day. It is not working. It is completely infuriating ATO’s dad. If once ATO thinks that you are deliberately not submitting a declaration form, or is falsely providing a declaration, then they will Will feel that we are such a big spectrum, so authoritative government agencies, you are deceiving the government ah, young people!

You are likely to face not only fines of nearly 10,000 knives, but even 12 months in jail! Out of jail and want to stay in Australia? No door, flew to you to send home!

To see if there is a trace of fear in the end, even if a small foreign student is required to pay taxes in accordance with the law, we are still honestly paying taxes, studying safely, and not challenging the authority of ATO!

Leaver a comment