The key words of China-Australia real estate industry are better than you don’t know.

Now, more and more Chinese investors have turned their sights abroad to seek an investment platform that can achieve a steady appreciation of wealth.

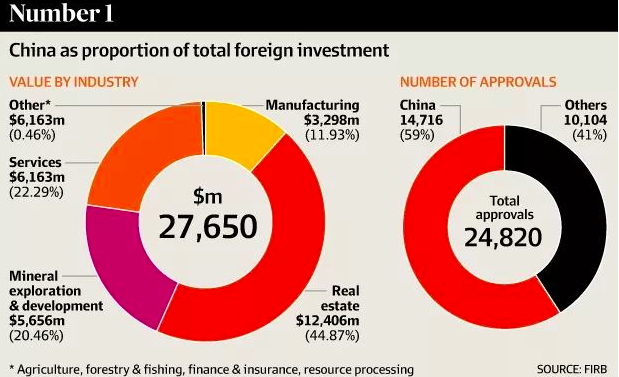

According to data from the Australian Overseas Investment Review Board (FIRB), the annual value-added rate for real estate in Australia has been between 7% and 15% for the past 40 years. From 2014 to 2015, the total amount of Chinese real estate investment in Australia was approximately RMB 118.8 billion. RMB. Today, China has surpassed the United States as the largest source of approved foreign investment in Australian real estate.

So, what are the differences between the real estate industries in China and Australia? The following set of keyword comparisons will give you an intuitive concept:

Property rights

China: 70 Years of Property Rights

Australia: Freehold

2. Acquisition time of property rights

China: Some time after the delivery of existing homes

Australia: when the existing house is delivered

3. Initial payment

China: Pay 20% or more when signing a contract

Australia: 10% when signing a contract

4. House area

China: Building Area

Australia: Actual use area

5. Mortgage loans

China: China repays funds immediately after signing a contract, with interest

Australia: There is no need to pay immediately after signing the contract, and the repayment will not begin until the existing house is delivered.

6. Ways of repayment

China: Principal interest at the same time, pressure on loan repayment is high, and buyers are under tight cash flow.

Australia: Can also be interest-free at the same time, but also can not only return the principal interest for a certain period of time, repayment pressure can be adjusted

7. Funding risks

China: First-off payment to developers, investors will suffer losses if there is a shortage of funds for developers

Australia: The first payment is deposited in a government-supervised trust account, and developers have no right to use it before submitting a house

8. Market and legal situation

China: At the stage of continuous rectification, policies and regulations have changed greatly, and market volatility is also large

Australia: Mature and transparent regulations to protect the interests of buyers and sellers

9. Legal protection

China: Information asymmetry between developers and owners, laws are not perfect, and the interests of owners are difficult to protect

Australia: Perfect and Perfect Legal System, All Contracts Are Handled by Professional Lawyers, Effectively Protecting the Owner’s Immediate Interests

10. Loan again

China: It is more difficult to obtain a bank pass and it is difficult or impossible for the house to cash out.

Australia: Increase the loan at the market price at any time and withdraw the appreciation portion of the house without selling the house to reinvest the next property

11. The developer’s credit system

China: There is no sound unified credit agency, developer information is not perfect

Australia: Well-developed, high developer integrity, low delivery risk for purchasing 期房 in Australia

12. Lease Management

China: The housing lease management system has not yet reached scale, specialization, and standardization, legislative work is lagging behind, and rental management companies lack follow-up services.

Australia: The leasing industry is relatively formal. The leasing management company can provide investors with a range of services, including listing of rental advertisements, selection of tenants, management of properties, collection of rents, payment of fees, etc.

13. Freedom of housing sale and inheritance tax system

China: long period of property rights conversion, restrictions, high inheritance tax

Australia: Private ownership is sold with purchase, regardless of existing homes, and there is no inheritance tax

14. Tax benefits

China: The tax refund for investment houses is very low

Australia: Deduction of certain income tax (depreciation from Australian property purchases) through depreciation or other intangible and tangible expenditures

15. Buying a house

China: First-time home purchase without concessions, luxury homes with double deed tax, property sold for two years with full sales tax

Australia: Australia’s Benshi residents or permanent residents will be subsidized by the government for the first time, exempting part of the purchase stamp duty and loan stamp tax

After comparison, it is not difficult to see that compared with China, the Australian real estate market is more mature and standardized, and the credit system and lease management system are relatively sound and perfect.

Australian real estate is freehold property, there is no inheritance tax, the investment threshold is low, and the repayment pressure is small. The 期房 does not have the risk of being sloppy and can be rented immediately after delivery, and can also enjoy negative tax deductions. High rental yield and low vacancy rate are suitable for medium and long-term investment.

From an investor’s point of view, no matter what investment field, in addition to the rate of return, the risk is also an important reference indicator. Investing in Australian real estate is a good option for both high returns and safety.

Leaver a comment