What is the purpose of investing in overseas real estate? China’s high-net-worth people overseas home-buy drivers and demand analysis!

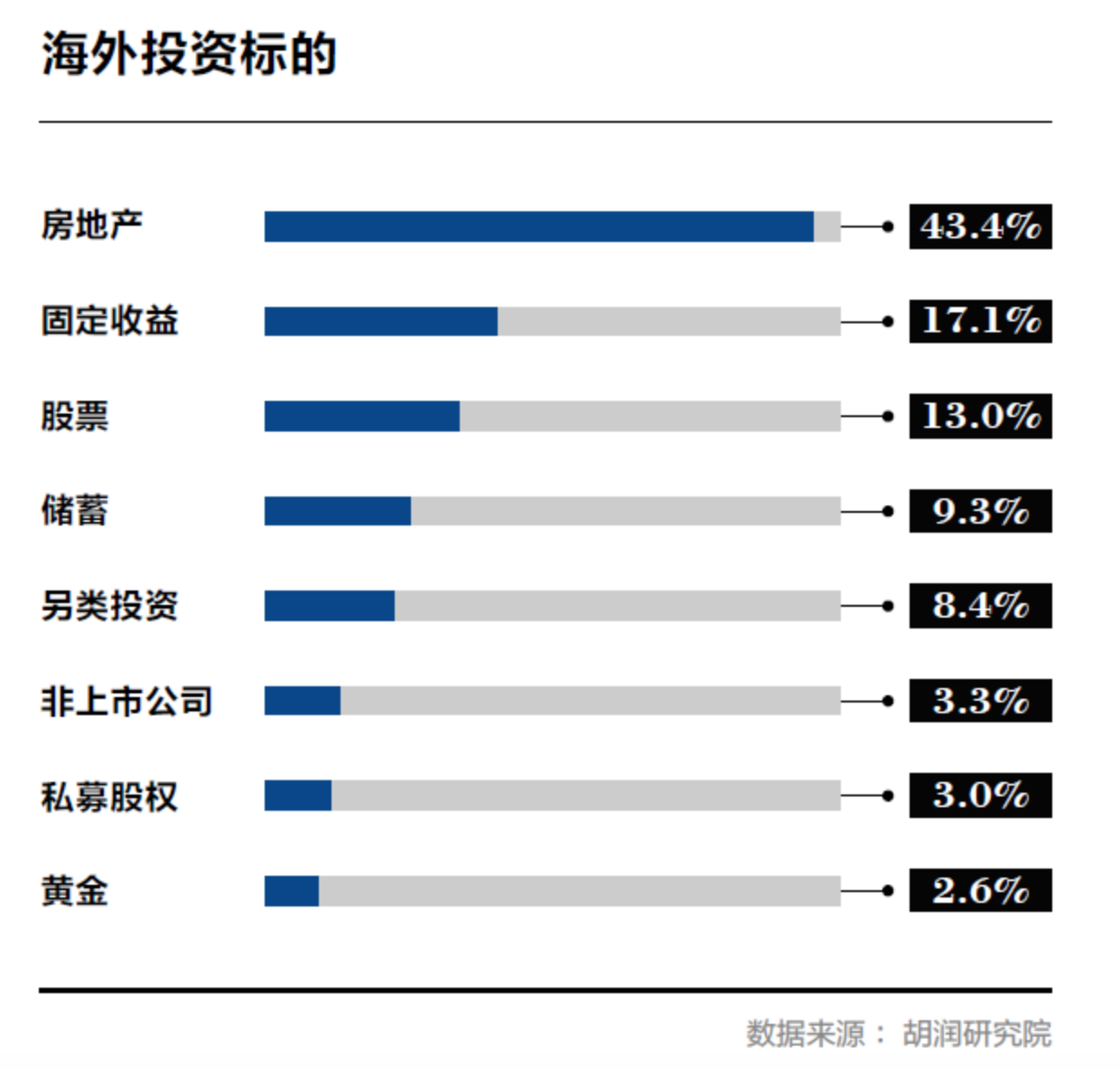

Compared with the domestic “rich” real estate market, according to the Hurun Research Institute’s survey, nearly half of China’s high-net-worth individuals take overseas real estate investment as their main target. They have an average of 2.3 sets of overseas real estate and have 4 sets of The proportion of the overseas property owners is 15.6%.

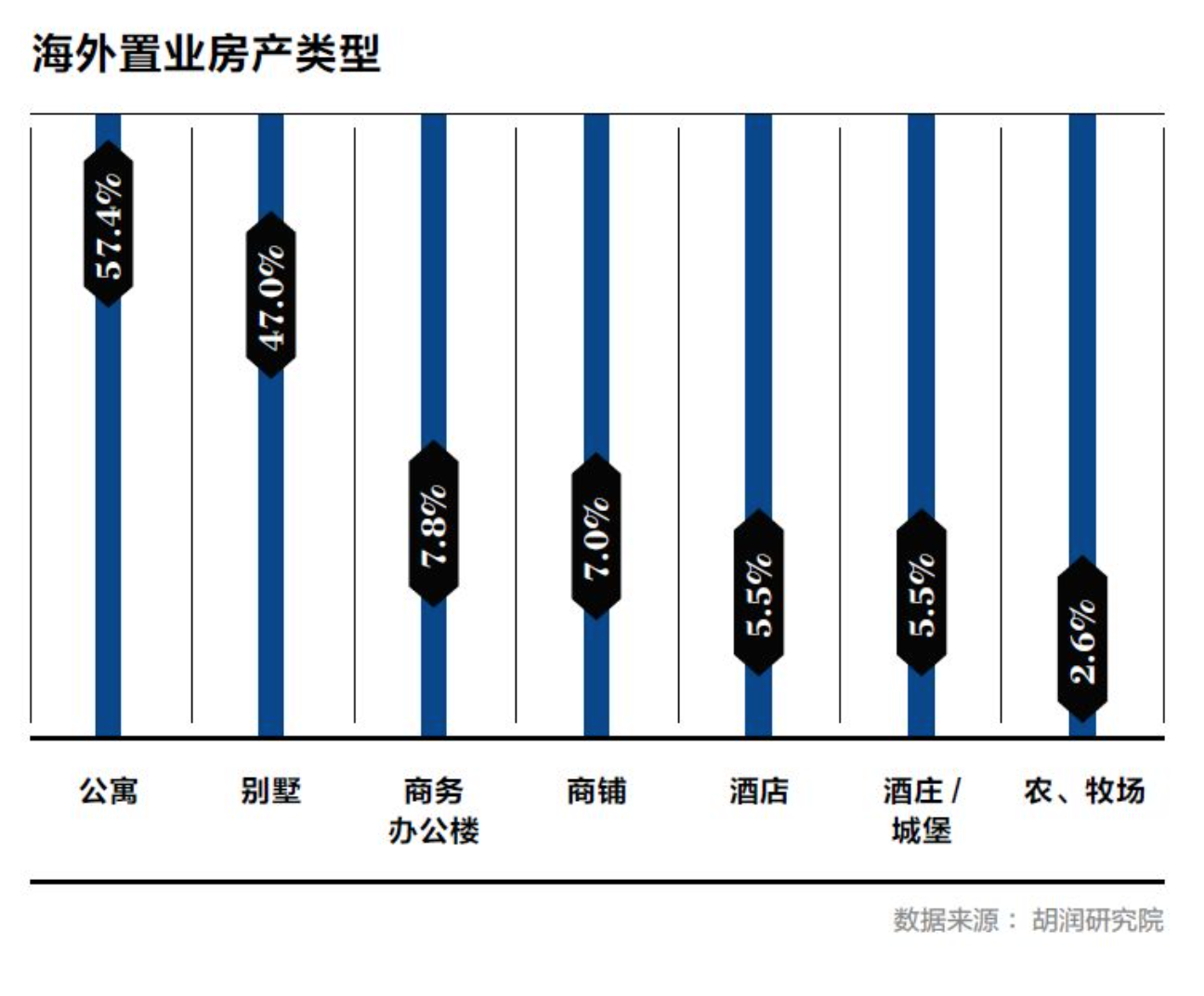

In addition, from the point of view of the type of property purchased, apartments and villas have become the most purchased overseas property types with high net worth. Commercial real estate is subject to investment thresholds, policy risks, large fluctuations in investment returns, and investors’ local economic rings. Affected by factors such as unfamiliarity, the proportion of overseas real estate properties is relatively low. Visible, residential real estate with its stable return on investment, more favored by high-net-worth people.

Analysis on Drivers and Demands of Overseas Real Estate Owners of High Net Worth in China

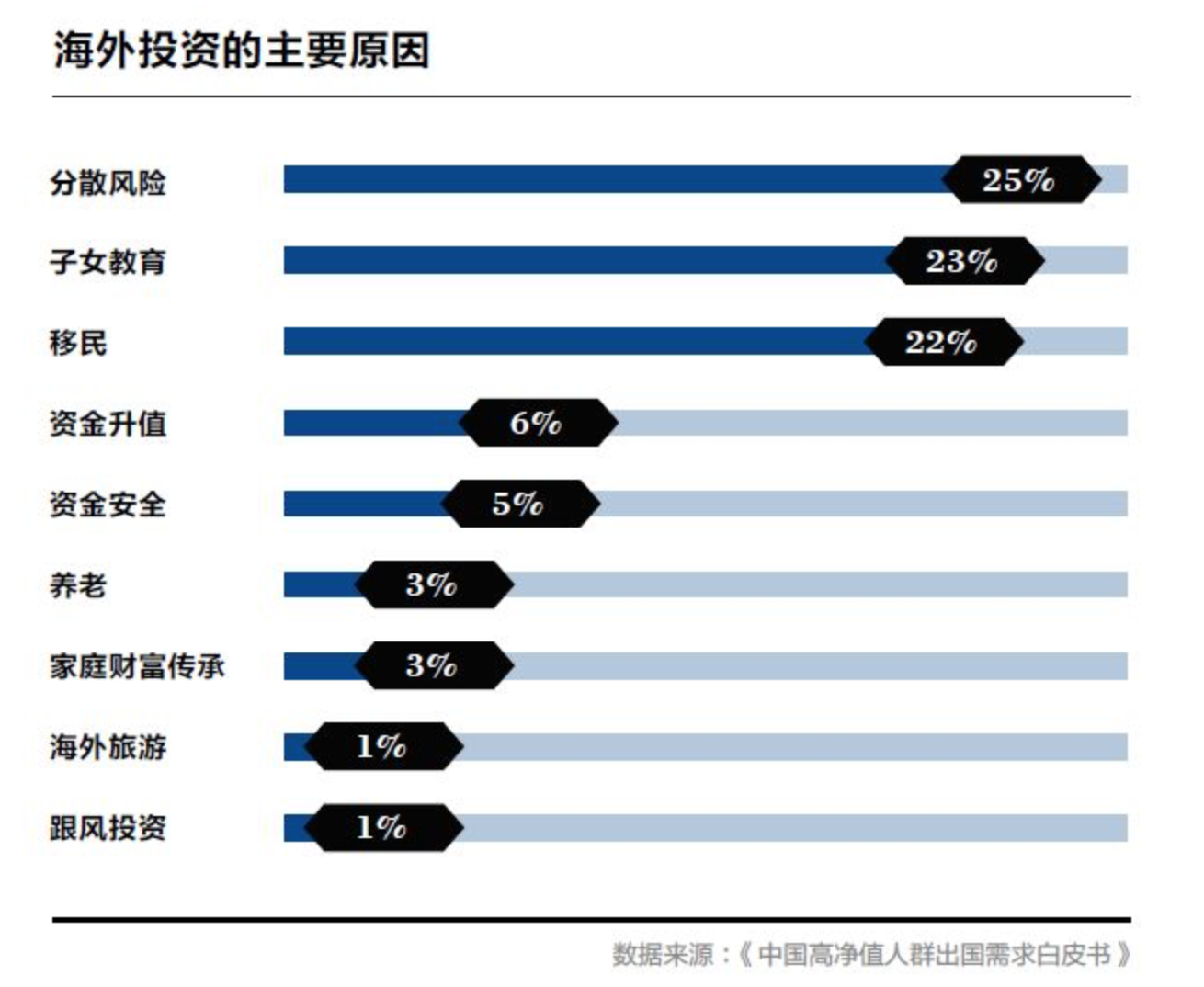

◆ Diversification risk

According to a survey conducted by the Hurun Research Institute, “spreading risk” is the most important reason why high-net-worth individuals in China purchase global real estate. In the third quarter of 2016, the national GDP growth rate was 6.7%, and the domestic economy was in a period of slow growth. In addition to the recent slump in the RMB exchange rate, more and more high-net-worth individuals began to look at the world and hoped to deploy overseas assets. To achieve their own asset preservation.

◆ Children’s education

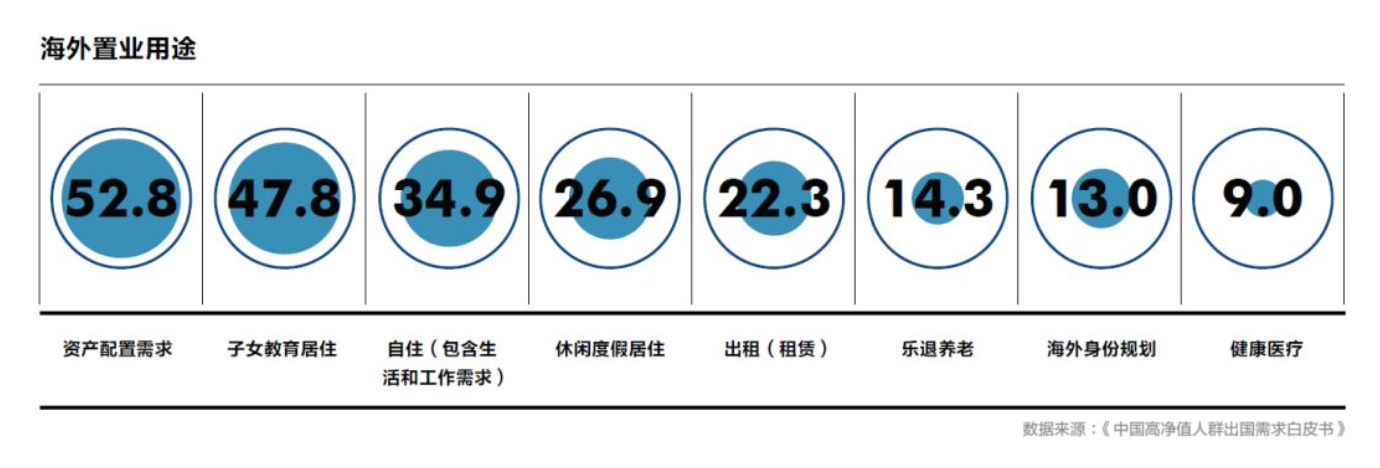

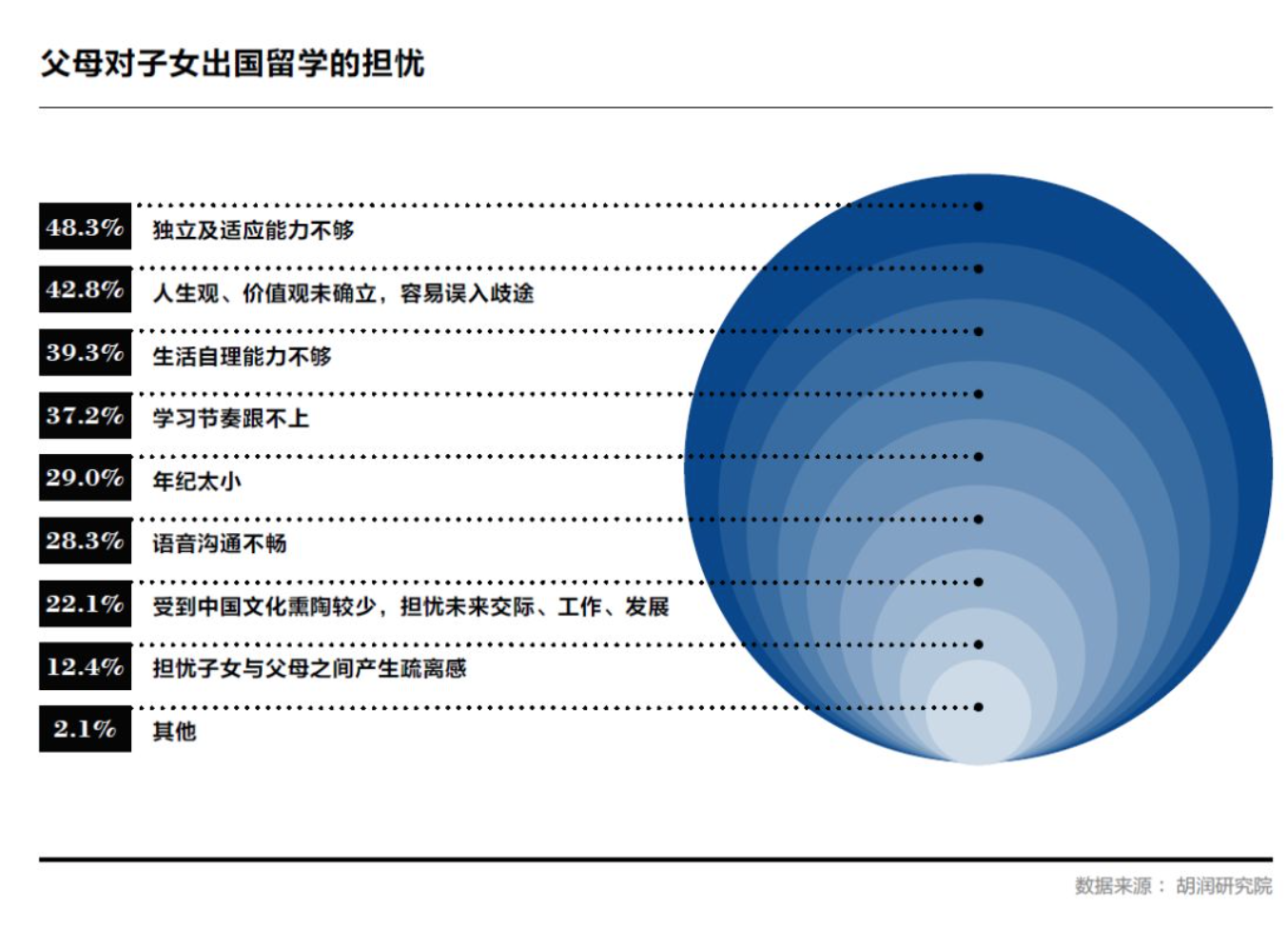

In recent years, the proportion of Chinese sending children to study abroad has been increasing year by year, and it is increasingly showing a trend of younger age. Therefore, overseas education of children has become an important driving factor for high-net-worth individuals to conduct overseas home purchases. We have found that parents are increasingly concerned about investing in “school district housing” because of concerns about young children and weak independence. This will not only make it easier for parents to “accompany reading”, but also solve their general life problems for their children. Similar to the domestic situation, some school districts with well-known academic countries also have very urgent demand for rent and considerable return on investment. According to our investigation, high-net-worth individuals are the first choice for overseas home purchases, with “School Housing” home ownership ranking 52%. This shows that the purchase of overseas real estate for their children studying abroad is becoming a new trend for high-net-worth individuals in China to conduct overseas home purchases.

◆ Channels and trends

In obtaining overseas real estate investment information, “friends and relatives and referrals” are their most trusted channels, accounting for 28.2%. However, “investment-related laws, regulations, and policies” are also blind spots of friends and relatives. Therefore, when asked about “difficulty in purchasing overseas real estate,” high-net-worth individuals generally believe that “the local economy and laws overseas “The environment does not understand” is the most important challenge for overseas investment in real estate, accounting for up to 60% of the population. At the same time, compared to investing in domestic real estate, the complicated and cumbersome process of buying overseas real estate and the high maintenance and holding costs also brought them certain difficulties. Therefore, some channels that can provide “one-stop” services for overseas investment properties will become a major demand for high-net-worth individuals to conduct overseas home purchases.

Leaver a comment