Why do rich people generally love Australia? Let Li Ka-shing tell you what’s really good for investing in Australia!

A report by New World Wealth, a wealth research company, said that in 2016, about 11,000 millionaires became Australia’s “new immigrants,” a 40% increase from 2015 figures.

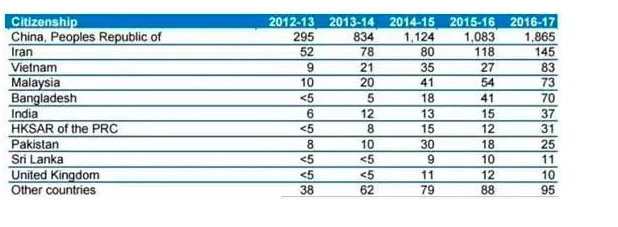

According to the data released by the Australian Immigration Service, the number of investors from Australia is far ahead of other countries.

Li Ka Shing contracted the whole of Australia? Follow Australia’s footsteps to invest in Australia

Millionaires emigrated to Australia, mainly because of Australia’s sunny lifestyle, its well-established medical insurance system, and Australia’s commercial advantages.

Australia is the best bridge to connect several emerging market countries, providing great convenience for the global business of the rich.

Li Ka-shing, whose investment territory spans the rest of the world, invested $42.4 billion at the beginning of last year to invest in infrastructure projects in Australia. It is also a direction for Australian investors.

“Whereever there is a return, I will invest where I want to go!” Li Ka-shing once said at the annual dinner of the Cheung Kong Group in early 2017.

As early as 1999, Hong Kong business giant Li Ka-shing has begun to flex its muscles in the Australian real estate market.

The assets of Li Ka-shing’s group in Australia cover infrastructure, industry, brewing, telecommunications, food, and resources. The acquisition of Duet, the Australian infrastructure group, in January 2017 was the latest move of Li Ka-shing’s entry into Australian infrastructure.

The arrogant president Li Ka-shing’s “great fortune” to Australia, to a certain extent, also reflects the great investment value of Australia’s hot land.

Market analysts pointed out that the Changhe Group controlled by Li Ka-shing is committed to exploring the Australian market in order to diversify overseas investment and reduce the risks posed by world economic fluctuations. Whether it is industrial investment or commercial investment, it is always right to follow the footsteps of investment. It is precisely because of this that the domestic rich have also invested and bought home in Australia.

Over the past four years, the value of Australian property has been rising at a rapid rate, and Australian house prices have grown faster than most of the most popular countries.

The 2017 China-Australia Tourism Year, the Australian 10-year tourism visa, and the opening of visas for overseas students have caused the Australian population to face a new expansion and will also drive the continued rise of Australian real estate.

Australian property leader leads three major advantages to attract investment

Australia’s leading real estate has become a keen destination for overseas Chinese home buyers. According to a recent survey of overseas home buyers, 38% of high-income people choose to buy in Australia.

Why the Chinese people so favor Australian real estate, can not do without the following factors.

1. Australia has beautiful natural scenery and superior human environment

Education resources are advanced and it is a country that welcomes immigrants. These factors have contributed to the sustainable development of the Australian real estate market. According to the statistics of Australian real estate values over the past 40 years, Australian real estate has doubled in average every 7-10 years. This steady growth will bring stable investment returns.

2. Australian property is freehold and there is no inheritance tax

For high-net-worth people in China, overseas home ownership is not only a means to improve the allocation of assets, but also an important asset passed down by the family. Buying a house in Australia, no matter how much it buys, can be passed down safely and securely for generations, which is very much in line with the traditional Chinese concept of passing on from generation to generation.

3. Australian property profitability is flexible

The bank can perform a secondary valuation on the purchased property. If the assessed value is already higher than the value at the time of purchase, the investor can obtain the value-added portion from the bank through refinancing to realize the financing. Therefore, Australian real estate is very suitable for long-term holding, it can provide investors with continuous and stable income.

Leaver a comment